In the bustling world of finance, the distinction between an average trader and an elite one often comes down to specific skill sets. Trading is not merely about buying and selling; it requires a nuanced understanding of the market, as well as the psychological fortitude to navigate its ups and downs. If you’re aspiring to elevate your trading skills, it’s essential to recognize the foundational abilities that set top traders apart.

Here are the top five skills that define elite traders.

Skill #1: Vast Knowledge of Trading Basics

To embark on your trading journey, a comprehensive grasp of trading basics is non-negotiable. For instance, understanding what day trading entails is crucial. Day trading involves buying and selling financial instruments within the same trading day. This practice demands that you familiarize yourself with and implement various day trading rules, regulations, and strategies that govern the activity.

Moreover, a solid foundation in trading basics includes recognizing the different types of trading styles. Whether you’re inclined towards day trading, swing trading, or position trading, each style has its unique characteristics and strategies. Mastering these aspects will empower you to make informed decisions and develop your trading plan effectively.

Skill #2: Analytical Thinking and Market Analysis

Analytical thinking is another cornerstone of elite trading. As a trader, you must be adept at interpreting vast amounts of data and identifying patterns. This skill involves breaking down complex information into manageable parts, enabling you to make sound decisions based on evidence rather than emotion.

Market analysis involves two main approaches: fundamental analysis and technical analysis. Fundamental analysis examines economic indicators, company performance, and industry trends to gauge the intrinsic value of a stock. On the other hand, technical analysis relies on statistical trends derived from trading activity. Balancing both approaches can significantly enhance your understanding of market dynamics and improve your trading outcomes.

Skill #3: Emotional Intelligence and Risk Management

Emotional intelligence is critical for traders looking to maintain a clear perspective amidst market volatility. Trading often triggers a range of emotions, from excitement during winning trades to frustration during losses. With emotional intelligence, you can manage these feelings effectively, allowing you to make rational decisions, even under pressure. Recognizing your emotional triggers and developing coping strategies will prevent impulsive actions that could lead to significant losses.

In tandem with emotional intelligence, effective risk management is essential. As a trader, you need to understand the importance of setting stop-loss orders, which help limit potential losses on trades. Establishing these parameters before entering a trade allows you to maintain control over your capital and protects you from substantial downturns. Furthermore, diversifying your portfolio is another critical aspect of risk management.

Skill #4: Adaptability and Continuous Learning

The financial markets are inherently dynamic, making adaptability a crucial skill for successful traders. As a trader, you must be willing to pivot your strategies in response to changing market conditions. This might involve adjusting your trading style, exploring new asset classes, or tweaking your analytical methods. Embracing change and remaining flexible will ensure you stay relevant in an ever-evolving landscape.

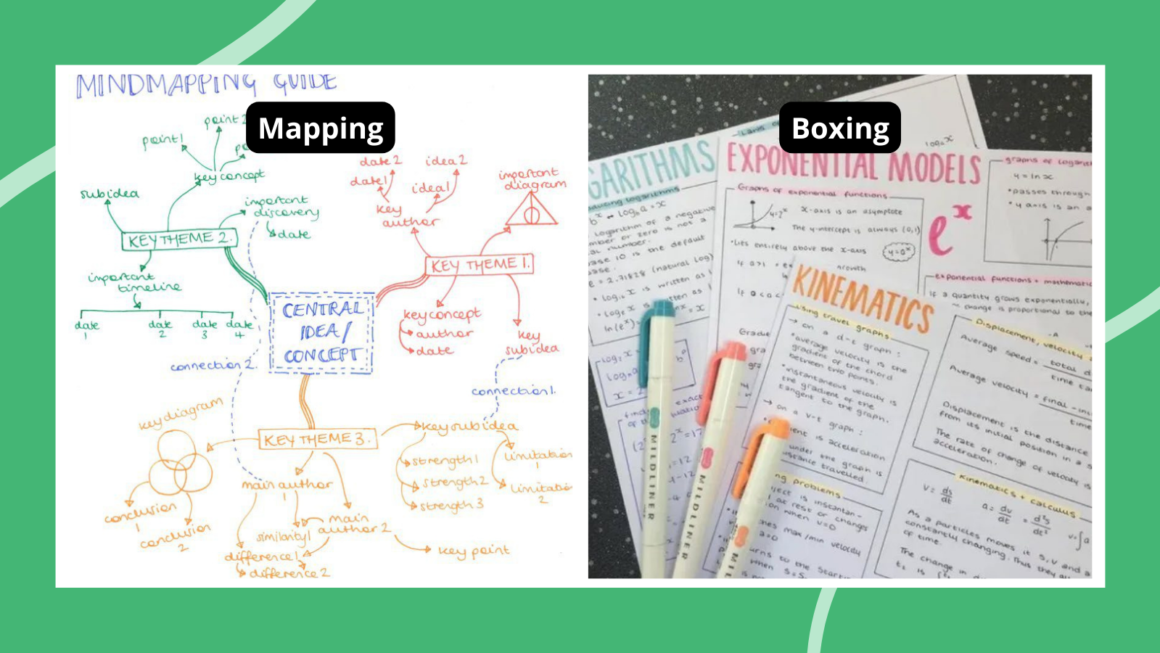

Continuous learning is equally important in your trading journey. The most successful traders are those who commit to lifelong learning. This encompasses not only expanding your knowledge of trading strategies but also understanding economic theories, behavioral finance, and new technologies that influence trading. Participating in webinars, reading books, and engaging with trading communities can enhance your knowledge base and expose you to diverse viewpoints.

Skill #5: Discipline and Patience in Trading

Discipline and patience are indispensable traits for any elite trader. The ability to stick to your trading plan, even in the face of market fluctuations, is crucial for long-term success. This means adhering to your predefined strategies, risk management protocols, and emotional control techniques. When you practice discipline, you minimize the likelihood of making impulsive decisions that could jeopardize your financial well-being.

Patience is equally important in trading. The urge to act quickly can be tempting, especially in a fast-paced market. However, great traders understand that not every moment demands action. Waiting for the right conditions and opportunities to arise can lead to more favorable outcomes. This means resisting the urge to chase losses or jump into trades without adequate analysis.

Conclusion

In conclusion, becoming an elite trader requires a multifaceted skill set that encompasses knowledge, analytical thinking, emotional intelligence, adaptability, and discipline. You need to develop these skills so you can significantly enhance your trading performance and achieve your goals.